This article is based on a presentation given by Nick at the virtual Customer Success Festival, in March 2023.

Catch up on this presentation, and others, using our OnDemand service. For more exclusive content, visit your membership dashboard.

Unlock the secrets to boosting customer lifetime value (CLV) and discover proven strategies for skyrocketing retention, renewals, and expansion rates. Are you ready to gain valuable insights on optimizing the customer journey? Then read on...

I’m Nick Chang, VP of Global Customer Success at Aryaka, a $110M annual recurring revenue cybersecurity and unified SASE (secure access service edge) company. We pride ourselves in providing services like SD-WAN, SASE security, and last-mile services to our enterprise customers.

In this article, I’m going to equip you with practical tips on how to enhance customer lifetime value through effective retention, renewals, and expansion strategies. While the best practices I'll share may not apply universally across all industries, I'm confident that they will offer valuable insights for your business.

We’ll explore three main areas:

- The customer journey: A snapshot of what a typical customer journey entails.

- Roles and responsibilities: Here I’ll clarify who exactly participates during this journey process, ensuring a common understanding of the terminology before we delve into the nitty-gritty.

- Step-by-step guide: This part is a detailed explanation of how to ensure the retention and renewals transpire seamlessly at the end of the contract.

To wrap up, I'll share some final thoughts based on my wealth of experience in this sector. I hope you find this guide extremely useful. So, without further ado – let’s dive in.

Objectives of a customer success organization and tailoring strategies for success

Every company with a customer success organization primarily revolves around one or more of these three objectives: value assurance, churn reduction, and demand expansion. We aim to fine-tune the retention, renewals, and expansion strategies based on the specific objectives of the customer success organization within each company.

Value assurance

Customers need to see and realize the value of their purchase, be it in a SaaS business, an enterprise, a hybrid hardware-software model, a commodity business, or a B2C context.

The goal of the customer success organization here is to ensure that the value is realized and that adoption and expected return on investment (ROI) are achieved. Our focus areas include ensuring product adoption and providing sufficient education for our customers.

For instance, if we have customers with low consumption, we implement a plan to boost consumption and improve customer health scores. This is especially crucial for high-complexity products or companies in markets with low maturity.

Churn reduction

The second objective is retaining customers, which means reducing churn. Even if it means downgrading the service, the primary objective is to ensure a gross retention rate (GRR) of over 90%. The approach here shifts slightly; we strategize how to reduce the churn level, and how to alter customer touchpoints and interactions, all primarily aimed at customer retention.

Demand expansion

The third objective is centered around demand expansion. These organizations focus on strategies to increase the installed base and upsell or cross-sell products or services. Upselling could mean selling the same services to other groups or expanding those services, while cross-selling involves introducing new technologies or selling the same services to a different division within the same company.

We'll delve deeper into these objectives and their distinct components throughout the article and discuss how to tailor these strategies to your unique objectives.

The LACE model: A holistic approach to customer success

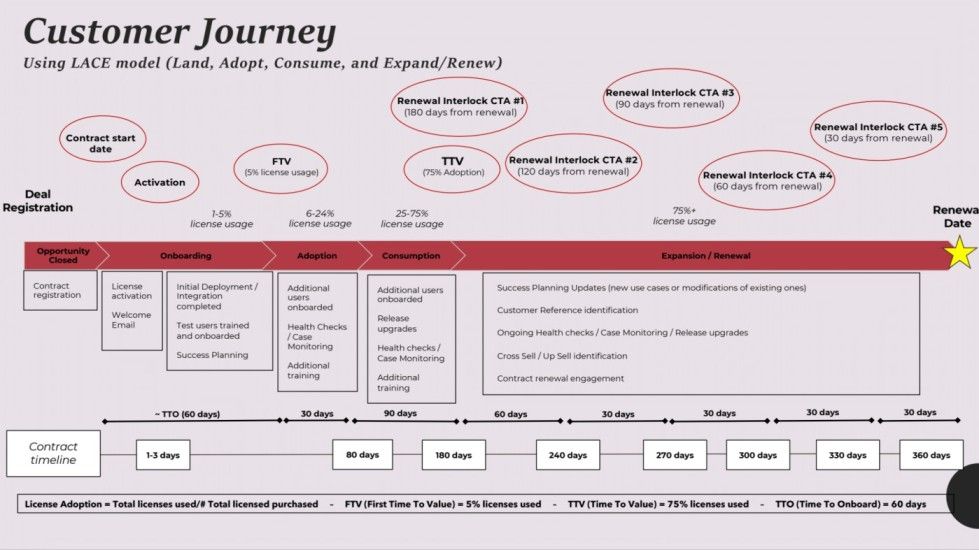

To set a baseline understanding, let's take a look at the LACE model, which stands for Land, Adopt, Consume, Expand, and Renew.

Many companies use a combination of these elements to guide their customer journey.

Land

Let's start with “Land." This is where the contract begins and the service is activated. We monitor license usage during the onboarding phase after some of the deployment has been completed. At this stage, we calculate the customer lifetime value for the first time.

Adopt

The next step, “Adopt” is centered around amplifying license usage through user onboarding, health checks, monitoring, adoption, success planning, and other supportive activities. The aim here is to boost user license usage between six to 24%, considered standard in the industry.

Consume

The “Consume” phase follows, where we aim to ensure 75% adoption or time to value (TTV). We check that customers are using the product by performing health checks and business reviews. At this point, all components should be active, and customers should start realizing value, marked as first time to value (FTV), followed by TTV.

Expand and renew

The final stages, “Expand” and “Renew,” are the longest. During these phases, there are various calls to action (CTAs) depending on the timeline: 180 days, 120 days, 90 days, 60 days, and 30 days before the renewal.

The reason for outlining this journey is to emphasize one key point for ensuring retention, renewals, and expansion: these processes don't solely occur at the journey's end. Instead, they must be initiated and nurtured from the very beginning.

By understanding and implementing this journey, we can ensure that customer success initiatives are in place from the start and are carried through each phase. This holistic approach maximizes the chances of retaining customers, securing renewals, and driving expansion.

Okay, now let's dive into our step-by-step guide. I've broken this down into three key stages:

- Step one: Value realization and customer health

- Step two: Renewals/expansion roles and responsibilities by account tier

- Step three: Retention/expansion negotiations to close deals

Now, let's take a deeper dive into each of these steps. 👇

Step one: Value realization and customer health

The first step focuses on ensuring value realization and maintaining good customer health. Often companies focus heavily on the renewal side, making retention conversations much more difficult, especially when customer health is poor or the customer hasn't realized the value of their purchase.

This could manifest as low usage of licenses or bandwidth, poor education, subpar adoption, or ineffective execution of success planning. Before initiating any retention, renewal, or expansion conversations, it's crucial that we achieve this first step.

This first step is pivotal in ensuring these three areas are achieved before any retention, renewals, or expansion discussions with the customer. While it seems quite straightforward, let me highlight some examples where failing to meet these requirements led to substantial difficulties down the line.

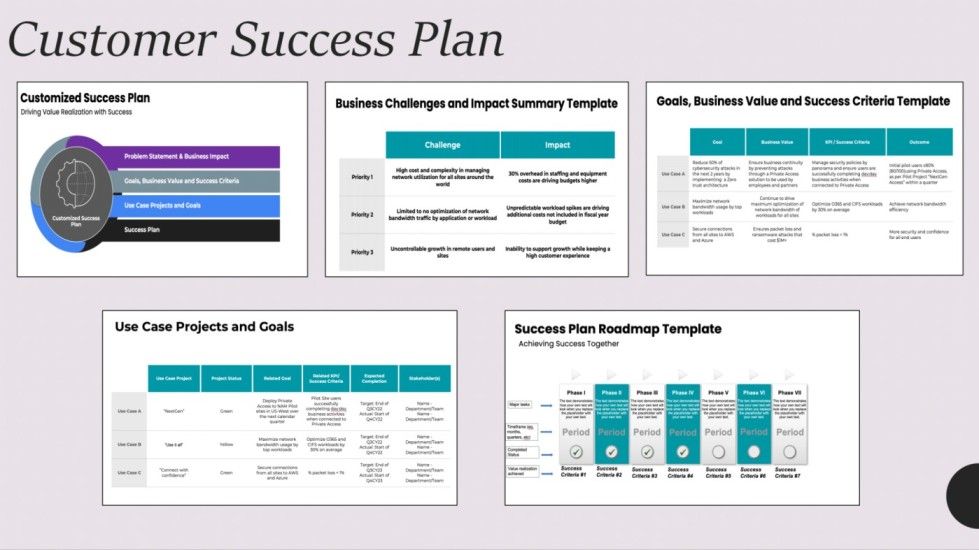

Success plans completed and goals achieved

Even if they're not fully realized, if at least 80% of the goals are accomplished, the customer begins to perceive the value of their investment.

Whether the goals revolve around cost reduction, enhancing the customer experience, expanding their business, or appeasing their end-users, they are defined by the customer. We must capture these as part of a use case analysis, linking it to our success plan.

Another crucial aspect of successful planning is ensuring that the criteria and roadmap are determined by the customer, not dictated by us. Regular communication is essential.

Customer health and product adoption = green

These can be assessed in many ways, based on product telemetry, the availability of reports, the customer's financial stability, and the impact of potential mergers and acquisitions, among other factors.

The adoption of the platform, product, or solution you're offering and whether it's being successfully utilized (“green state”) are dictated by these elements.

Effective business reviews

I've observed cases where customers, despite signing a contract (for instance, a 24-month contract), disengage over time.

Even though they use the service, they're not involved in business reviews. It's critical to at least conduct a business review every quarter, six months, or once a year, depending on customer engagement levels.

The business review is an excellent platform for helping the customer understand whether they've achieved the service, solution, or product value they've purchased. It's also an opportunity to present the product roadmap, highlight upcoming enhancements over the next three, six, nine, or 12 months, and share your company's strategy.

The business review session also aids in identifying additional use cases. To illustrate, consider a customer who purchased a Ferrari intending to leisurely drive it around Miami Beach. During the business review, they mention they now want to win a race. This is an additional use case identified during the review, offering an opportunity for upsell conversations.

An effective business review should also tackle any outstanding support cases or roadblocks hampering the customer's adoption or value realization of the product. This helps to clear the way for discussions about expansion and renewal.

Step two: Renewals/expansion roles and responsibilities by account tier

In this second step, I want to emphasize three key areas:

- Retention and expansion strategy based on account tier,

- Roles and responsibilities, and

- Business forecast models.

The second step is all about clarifying roles and responsibilities. In my experience, driving renewal and expansion conversations often depends on the structure of your organization. Your customer success team needs to collaborate closely with your sales team, whether they're focused on new sales or renewals.

Additionally, constant interaction with your customer success operations teams is essential to ensure you have the correct contracts and quotes ready to submit to the customer at the right time.

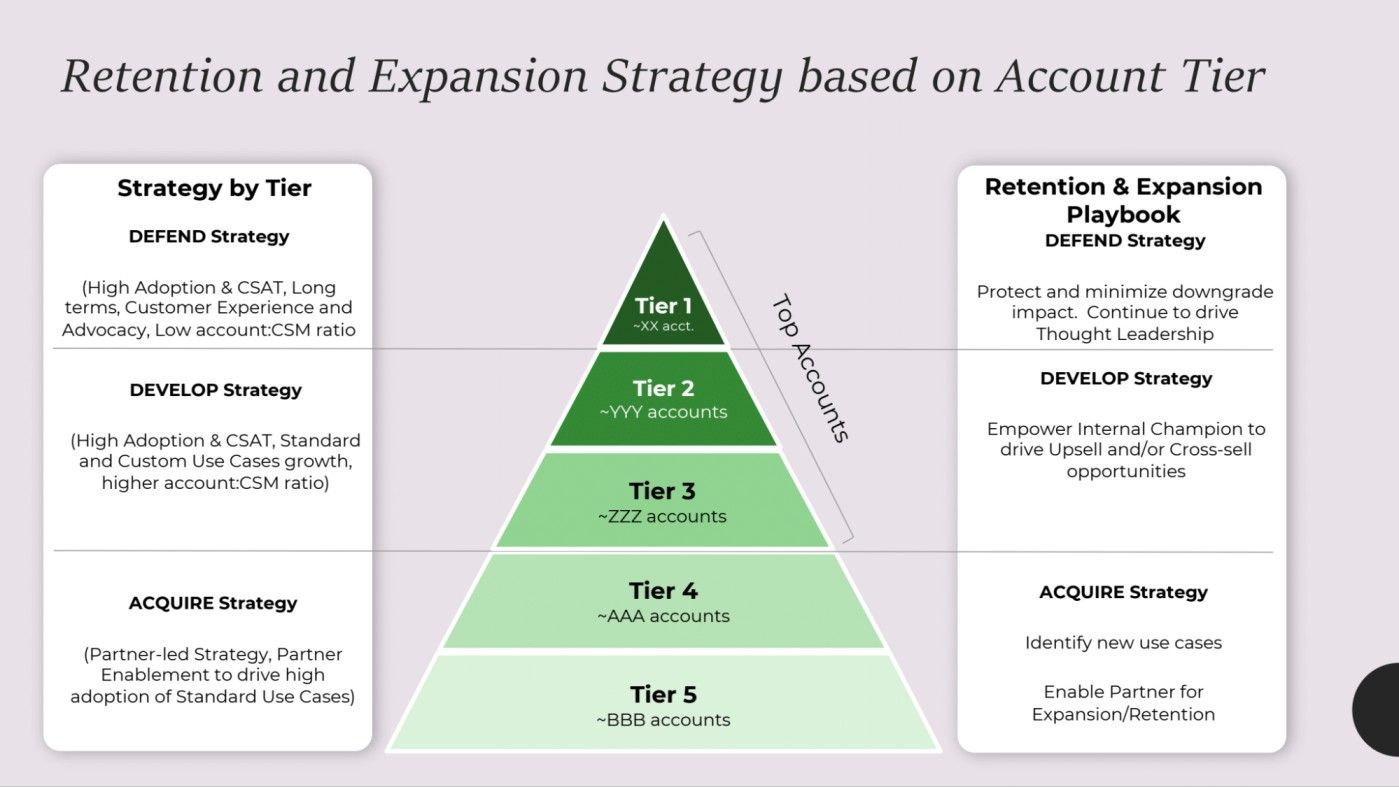

Retention and expansion strategy based on account tier

As we all know, not all accounts are treated equally. The classification of your accounts can vary vastly depending on your company or organization. You could have a tiered system with one, two, four, 10, or even more tiers. It's crucial to have a clear definition of these tiers.

When discussing the retention and expansion strategy based on tiers, consider this example where we have five tiers:

Tier one

This is what I would call the "defense strategy" tier. In this tier, there are no expansion opportunities, only retention strategies. The focus is on how to protect the base, keep customers from going to a competitor, and minimize any downgrade impacts.

Tiers two and three

I refer to these as the “trilogy” of accounts. They start small but have the potential for adding more licenses, bandwidth, CPU power, etc. Here, the key is leveraging your internal champions – those already enthusiastic about your solution. These champions can help drive upsell and cross-sell opportunities. This not only represents an opportunity for upselling but also reinforces retention for the services in that area.

Tiers four and five

These are the "acquire-strategy" tiers. These accounts could be brand-new that start small and grow, or new accounts that are just coming in.

Here, the strategy could depend heavily on partners or the partner ecosystem to acquire these accounts. At the same time, there could also be direct deals that start small and then renegotiate for larger contracts as time goes on. The key to the acquisition strategy is to identify new use cases, especially if you have multiple solutions to offer.

If a customer in these tiers only bought one out of five possible solutions, the goal is to drive interest in the other four solutions by tying them to use cases. Moreover, since this tier relies heavily on partners in my example, it's important to empower these partners to assist with expansion and retention conversations.

This tier-based strategy helps ensure a targeted approach for customer retention and expansion. By tailoring strategies according to the customer's stage and needs, you can optimize your results.

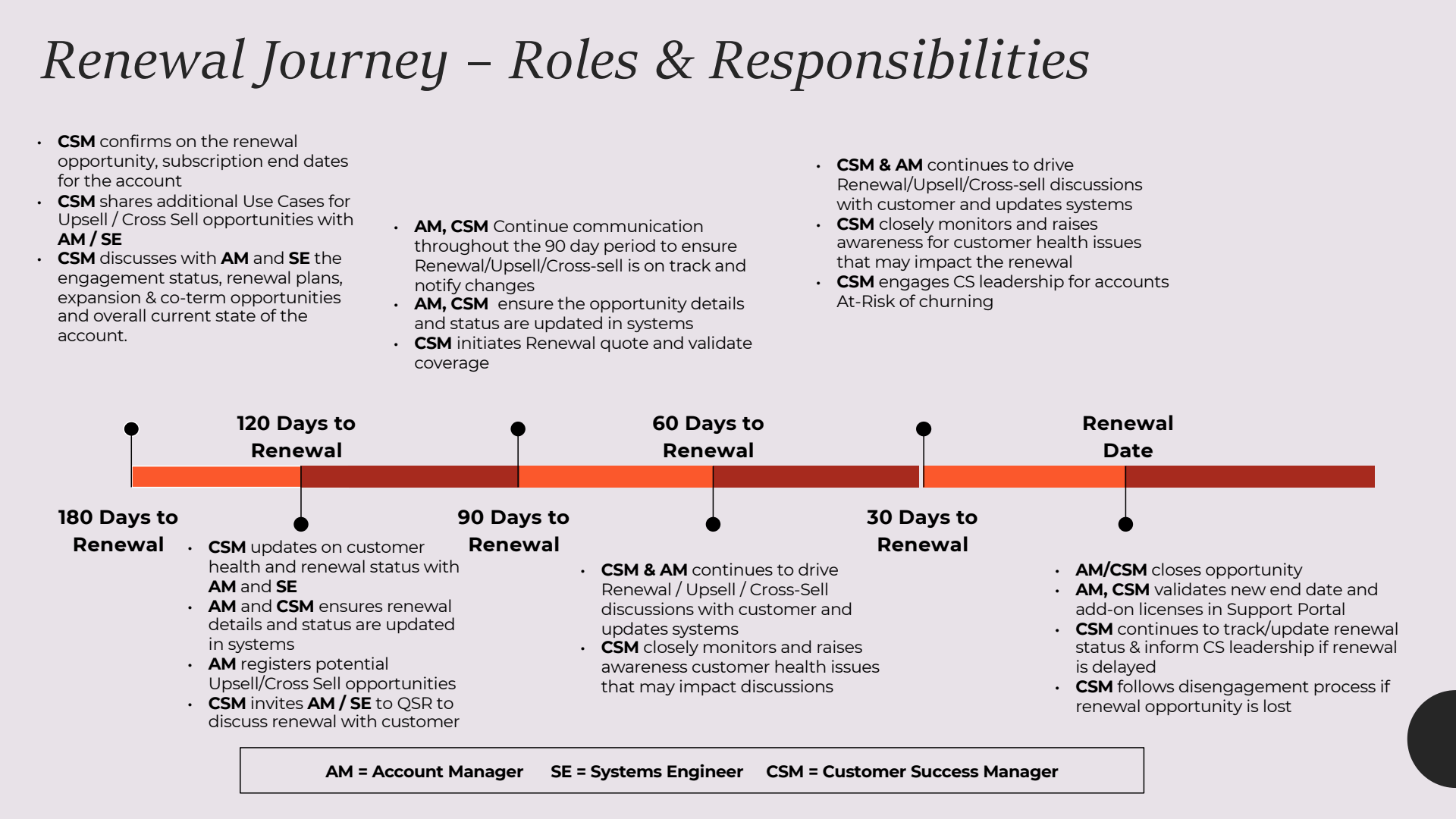

Roles and responsibilities

If you have a sales organization collaborating closely with your customer success team, you need to consider how these teams are motivated and compensated. If there's a separate renewals sales team working alongside your CS and sales teams, it's crucial to define who's responsible for what throughout the journey.

In this section, the emphasis is placed on the importance of clear roles and responsibilities in the account management process, particularly during the renewal journey. This structure typically includes an Account Manager, a system engineer, and a Customer Success Manager (CSM).

Having clear roles avoids confusion for the customer and prevents instances where different representatives send conflicting information, such as different renewal calls or prices. Consistency in customer interaction is crucial, and a single person should be identified as the opportunity owner in your CRM system.

Renewal activities are usually planned according to the timeline left until the renewal date (180 days, 120 days, etc.). Two approaches to renewals and upsells are discussed: one at the renewal time, which could either extend the current contract or add new solutions, and mid-term upgrades, which occur when the client decides to purchase additional services partway through their contract term.

Each approach requires a clear understanding of roles and responsibilities throughout the process, to ensure a smooth customer journey and maximize the potential for successful renewals and upsells.

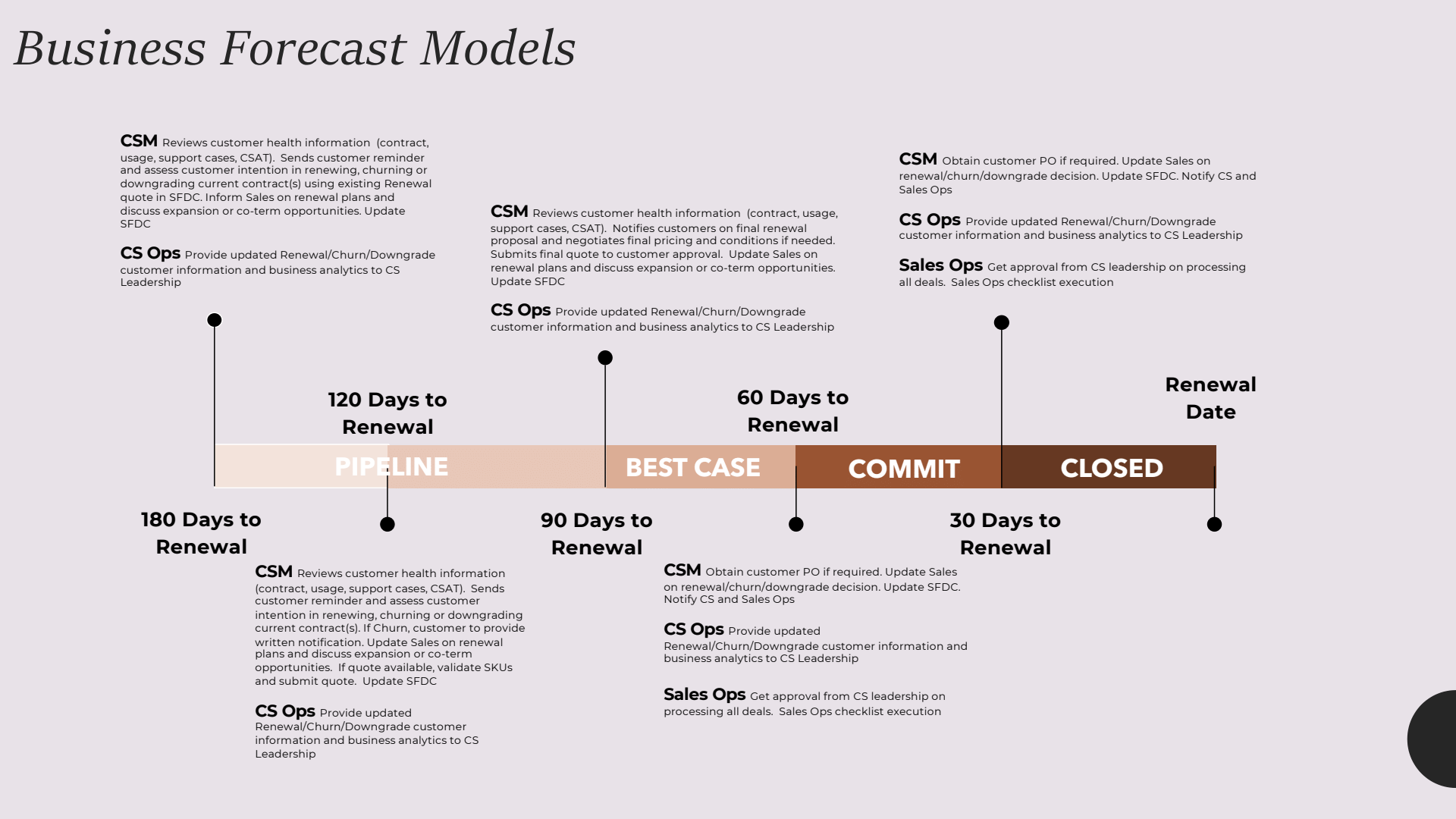

Business forecast models

Make sure your business forecast models are up-to-date and follow a consistent format and process. This allows you to capture all different deals at their various stages effectively and measure the renewals and expansion revenue you aim to close by the end of the quarter.

These three aspects are fundamental for a successful strategy involving renewals, expansion roles, and responsibilities. It's about creating the right structure, alignment, and visibility to drive results.

The final area of emphasis in this process is the importance of maintaining a well-structured forecast model. This is necessary for providing accurate information to management about the state of renewals, upsells, downgrades, and mid-term upsells. Deals should be properly categorized to reflect their current stage accurately.

In the described model, all accounts at the initial and middle stages of the process (stages one and three) are categorized as "pipeline," signifying active negotiations but no price agreement. When pricing negotiations commence, deals are moved to the “best case” category. This is an important stage where the precise customer requirements in terms of solutions and use cases are known, and the deal's cost and terms and conditions are negotiated.

When the deal reaches a 95% likelihood of completion, it is moved to “commit,” indicating that a renewal or expansion is highly likely. Upon closing the deal, it is moved to 'close' and recorded in the system for processing and entitlement. Maintaining this structure is crucial for transparency and smooth operations, preventing stagnation and confusion in deal flow.

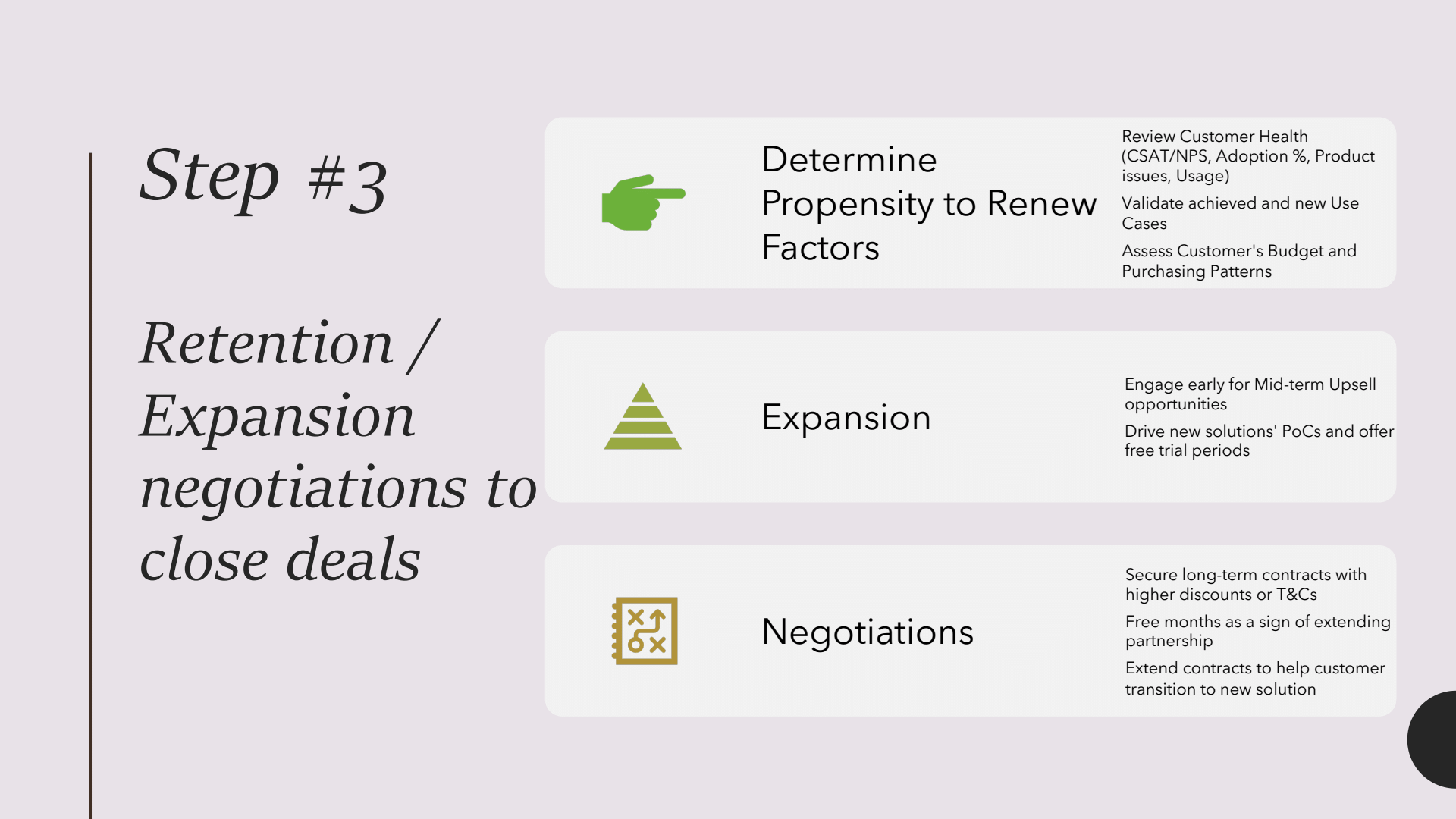

Step three: Retention/expansion negotiations to close deals

The final step in our process is handling expansion negotiations to close deals. This comprises several critical areas to ensure success.

Firstly, before embarking on any negotiations, it's essential to thoroughly review a few key metrics. Look at the promoter score (NPS), and the adoption percentages of your product. It's also vital to evaluate the customer's budget and purchasing patterns.

For example, I've had highly satisfied customers, with impressive product adoption rates, that were suddenly acquired by another company, forcing them to cut costs. So, understanding your customer's context is crucial before you commence negotiations.

Secondly, when initiating negotiations, I favor the process of upselling mid-term rather than at the end during renewals. This strategy has two primary advantages.

Firstly, it fosters “stickiness” with the account. We know if they upsell mid-term, retention is virtually guaranteed.

Secondly, we can help pilot the solution by offering proof of concepts (POCs). This could be managed by your sales team or any relevant department. For instance, if a customer already has a basic product, you can offer them a chance to try out new, advanced features. Successfully implementing POCs can significantly aid the expansion process.

The third area of focus is the negotiations themselves. We always aim to secure long-term contracts by providing higher levels of discounts or amending the terms and conditions for customers willing to commit for longer periods. My preferred strategy is to promote longer contracts by offering greater discounts rather than discounts on shorter contracts.

Additionally, a common tactic is to offer a free month as a token of appreciation to extend the partnership. For instance, if there's a minor dispute about the price, offering 13 months of service for the price of 12 can be an effective way to resolve the issue. This tactic is highly effective in both B2C and B2B scenarios in the SaaS world.

Lastly, it's important to acknowledge that not all negotiations will be smooth. There will be instances when (to prevent churn) we might need to extend the contract to assist the customer as they transition to a new solution, either by another vendor or provided internally.

I've found that even extending a contract by a few months can provide additional time for negotiations and potentially facilitate retention or upselling. From the customer's perspective, this extension signals a strong partnership. Meanwhile, for us, even a short-term contract extension helps retain the account for a few more months.

Final thoughts

A successful expansion and renewal strategy requires active engagement, starting from the inception of the customer journey. Waiting until 100 days before renewal is a missed opportunity; start at the beginning to nurture and foster growth.

Another crucial element is alignment with your sales team. Regardless of how the sales organization is compensated for renewal and expansion, it's imperative to establish an effective partnership with your sales counterparts. Their role is invaluable throughout this journey.

Finally, the importance of being proactive cannot be overstated. In previous roles, I've experienced situations where we attempted to retain customers, but our efforts were in vain due to a lack of attention at the onset of their journey.

Even if you offer higher discounts, customers may refuse because it's not just about the financial aspects, but the partnership. They're looking for a reliable, trusted partner who is consistently attentive and proactive.

Hence, to build lasting relationships with customers, we must prioritize fostering partnerships over reactive discounts.

Audience Q&A 📣

Q: Given the growing customer tech stack, which often comprises five to 15+ tools, customers may not have time for quarterly business reviews (QBRs) with every provider. How do you persuade them of the value of your review and keep it as a priority?

A: In my experience, I find it more effective to think of these as business reviews rather than strictly QBRs because the frequency can vary based on customer preference. Some customers may prefer monthly reviews, others might want them annually. What's crucial is maintaining regular communication with the customer.

In instances where customers aren't keen on quarterly reviews, we opt for alternative methods of communication. For example, we send newsletters that include usage reports or summaries of support cases – information that would typically be covered in a business review.

These regular updates allow customers to stay informed on their terms and at their convenience. And rest assured, if a customer encounters a problem, they will reach out to you, often through support tickets.

It's crucial to stay engaged with customers, not just through business reviews, but also through newsletters, feedback, surveys, and sales interactions. If your customers come through a partner, it's also helpful to maintain regular contact with that partner to monitor the customer's interactions. In essence, the goal is to ensure consistent, tailored engagement with the customer.

What is your preferred communication style for renewal updates? Does an optimal method vary for different types of customers?

A: Indeed, the preferred communication style often depends on the account tier, as the level of service and engagement varies across tiers.

For example, with our tier four and five accounts, we primarily engage via email. Our customer success specialists notify customers of impending renewals, or we might send automated emails 180 days ahead of renewal. Because we offer an enterprise solution, the process isn't as simple as clicking for auto-renewal.

Instead, we provide a clause letting customers know their renewal date and what actions are required. If we don't hear back after several attempts, we might incentivize early renewal with financial benefits, such as a 5% discount for early renewal, or maintaining the current price if they renew within a specified period.

For tier-one accounts, our communication strategy is a mix of email, business reviews, and phone calls. These accounts represent a substantial portion of our business, and as such, they command more of our attention. Ensuring engagement with these customers during the renewal process is a top priority.

Q: What is a quick win to retain customers who're at a high risk of churn?

A: The number one strategy I would suggest is the “Hail Mary” pass. For example, we sometimes offer month-to-month contracts. While it's not our preferred model, it does provide us with some time to continue negotiations. There have been instances where customers only wanted one or two months — not because they were dissatisfied with the service, but because they needed to navigate certain mergers and acquisitions activities to gain a better handle on their budget.

Another approach is to offer shorter contract extensions. Instead of proposing 12, 24, or 36-month extensions, consider a six-month extension. This gives you more time to work with the customer. There will be cases where your customer is transitioning to another solution, and the best way to extend the relationship could be via shorter contracts.

Lastly, add some incentives. Expect and accommodate potential downgrades as well. A downgraded renewal is always better than no renewal at all.

Did you know this article is based on an awesome keynote presentation Nick gave at March 2023's virtual Customer Success Festival? If you're more of an audio learner, you might be interested in listening to the full video OnDemand.

So, if you enjoyed this article, why not experience the real McCoy?

When you attend one of our events you don't just walk away with business-changing insights like the ones Nick has imparted in this article, you have the chance to network and make career-defining connections.

Whether you're based States-side, down under or perhaps in Europe, we've got a plethora of in-person customer success conferences that are accessible to you. If that doesn't work out for you, don't sweat it – we host two virtual events per year, which are completely free of charge.